Over the last two years my wife and I have upped our travel game considerably. We’ve explored Japan, NYC, DC, Vermont, Montreal, St. Petersburg, and later this year we’re going to the Pacific Northwest and Chicago. Across all of this travel, we have not paid for a single flight or hotel room.¹

In early 2015 I entered the world of Travel Hacking — using credit card sign up bonuses and points to unlock dream vacations. Through my research and planning, I discovered everything I had learned about personal credit was wrong. Once I threw out the old rules, my Travel Hacking game exploded.

I’m not a financial expert and can’t give you any kind of advice of what to do with your money. Though over the last two years I’ve learned a lot of do’s and don’ts about traveling the world for free. Here’s what I discovered:

Don’t Be Afraid Of Opening A Lot Of Credit Cards.

For most people, limiting the number of credit cards they have open is great advice. Credit is dangerous if you’re not careful. I’ve seen people who see credit cards as free money and don’t realize that only making the minimum payment creates an impossible financial situation. However, for people who are careful and on top of their finances, opening a lot credit accounts will not hurt their credit score.

The reason for this? Available credit. Its counter-intuitive, but the more credit that is lent to you, the higher your score. You’re seen as a good risk since other banks were willing to lend you money.

The catch here is you need to pay off your credit cards in full. This is where people get into trouble. Having $100,000 in available credit looks great until the bank sees a $90,000 balance. However, having $100,000 in available credit and a $1,000 balance shows you as a risk worth taking.

Being a good credit risk means your score goes up and you have access to more cards. More cards means more bonus points and perks which translates into more free travel.

Do Have A Plan.

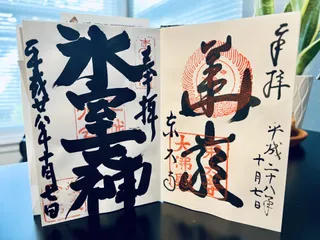

It’s not about opening just any credit card, it’s about opening the ones that will fulfill your travel goals. While planning our Japan trip, I researched which airlines I wanted to fly and which hotels I wanted to stay in. This led to the cards that I needed to apply for.

My goal was to fly Japan Airlines business/first class. Japan Air is part of the One World Alliance, meaning American Airlines points could purchase Japan Air flights. So I opened credit cards that would provide high sign up bonuses in American Airlines miles.

By meeting the sign up bonus spending amount (usually $3,000 in the first three months), my wife and I accumulated over 250,000 American Airlines miles in six months — more than enough to book our Japan Airlines flights. We followed this same plan with hotel cards, accumulating points and free rooms for Hilton and Starwood hotels.

Don’t Be Afraid Of Putting Every Dollar You Spend On A Credit Card.

This is the only way Travel Hacking works. Putting every dollar you spend on a credit card makes those minimum spending limits more obtainable. Gas, groceries, shopping, and dining are the easy ones. Did you know you can also charge your car insurance, cell phone bills, charitable donations, and (depending on your area) utility bills too?

The only things I don’t pay using a credit card are our mortgage, utilities, and lawn care bill. Both the mortgage and the law care company refuse to accept credit and our utility company charges a fee for using credit. That fee negates the points earned. However, if I were coming close to a deadline for a spending bonus, the fee might be worth the bonus points earned.

Do Keep Meticulous Records.

In order to take advantage of multiple sign up bonuses, you must keep amazing records and be on top of every single penny in your finances. If you don’t, then you will find yourself in situations where you can’t pay off your cards or you might even miss a spending limit. Doing so would negate any points you were trying to earn.

My wife and I use YNAB to keep track of everything we spend. Using this budgeting software, we are able to follow our progress toward minimum spending limits and know when it is time to move our spending to another card.

Keeping meticulous records before you begin a Travel Hacking plan will also create good habits. It will ensure you are meeting minimum spending limits without being frivolous or spending money on things you would otherwise not purchase.

Don’t Be Afraid Of Annual Fees.

Often times, the cards that will earn points toward your travel goals have an annual fee. Sometimes the fee is waved for the first year and sometimes it is not. If a fee is waved the first year, you can always ask after twelve months to have the fee waived; you might get lucky. If the fee is not waved the first year, the sign up bonus might be worth paying the fee anyway.

The US Air card (now Barclay American Airlines card) was one of the cards I opened in 2015. The card had a sign up bonus of 50,000 American Airlines miles and a $79 annual fee that was not waived. However, if I purchased 50,000 miles from AA directly, it would cost $1,475. The annual fee was a 95% discount on miles — well worth the cost.

This same logic translates to much larger annual fees on premium cards, like the American Express Platinum card. That card has a $550 annual fee that is due the first month the card is opened. However, in addition to the sign up bonus points, each year the card provides $200 in airline reimbursement and $200 in Uber credit, plus $100 Global Entry credit, airport lounge access, and more perks that negate the fee. Again, depending on your plan, the fee might be well worth paying.

Whatever your travel goals are, disciplined and careful Travel Hacking can help reduce your costs significantly. Do your research, create a plan, and don’t be afraid of what could be. The world is out there, go explore it!

¹: When using points for flights, airlines charge a nominal fee to cover security related expenses and airport fees. This amount varies depending on your travel plans. Our trip to Japan was just over $100 for both of us. Hotels do not charge any fees when paying with points.